louisiana inheritance tax return form

Louisiana inheritance tax return form Wednesday June 15 2022 Edit. Simply select the form or package of.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Ny State 2020 Tax Return Form Fill.

. While the estate is responsible. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross.

Get Access to the Largest Online Library of Legal Forms for Any State. Dont confuse estate tax with inheritance tax. What states have no inheritance tax.

Inheritance Tax Return - Resident Decedent. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. 3 11 106 Estate And Gift Tax Returns Internal Revenue Service.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Schedule B - Stocks Bonds. As of 2019 Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania have their own.

Import Your Tax Forms And File For Your Max Refund Today. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. There is no federal inheritance tax. Online applications to register a business.

Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. This affidavit must be notarized before it is submitted. Browse By State Alabama AL Alaska AK.

Access your account online. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. Ad Get A Jumpstart On Your Taxes.

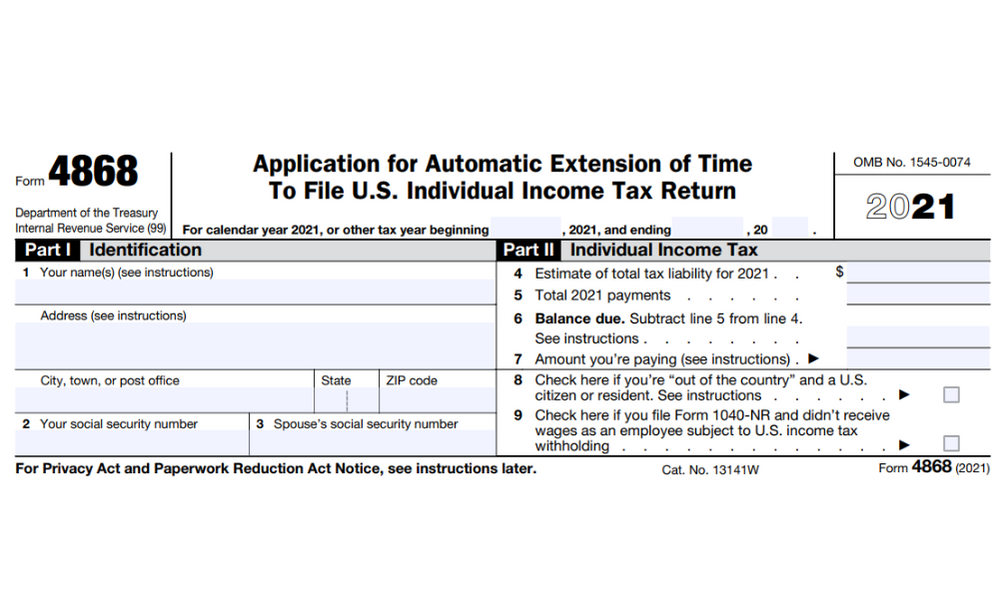

This affidavit must be notarized before it is submitted. Louisiana law used to require that an inheritance tax return be filed with the Louisiana Department of Revenue before a succession was opened. File your clients Individual Corporate and.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Schedule A - Real Estate. Download Inheritance and Estate Transfer Tax Return Form R-3318 Department of Revenue Louisiana form.

File returns and make payments. Find out when all state tax returns are due.

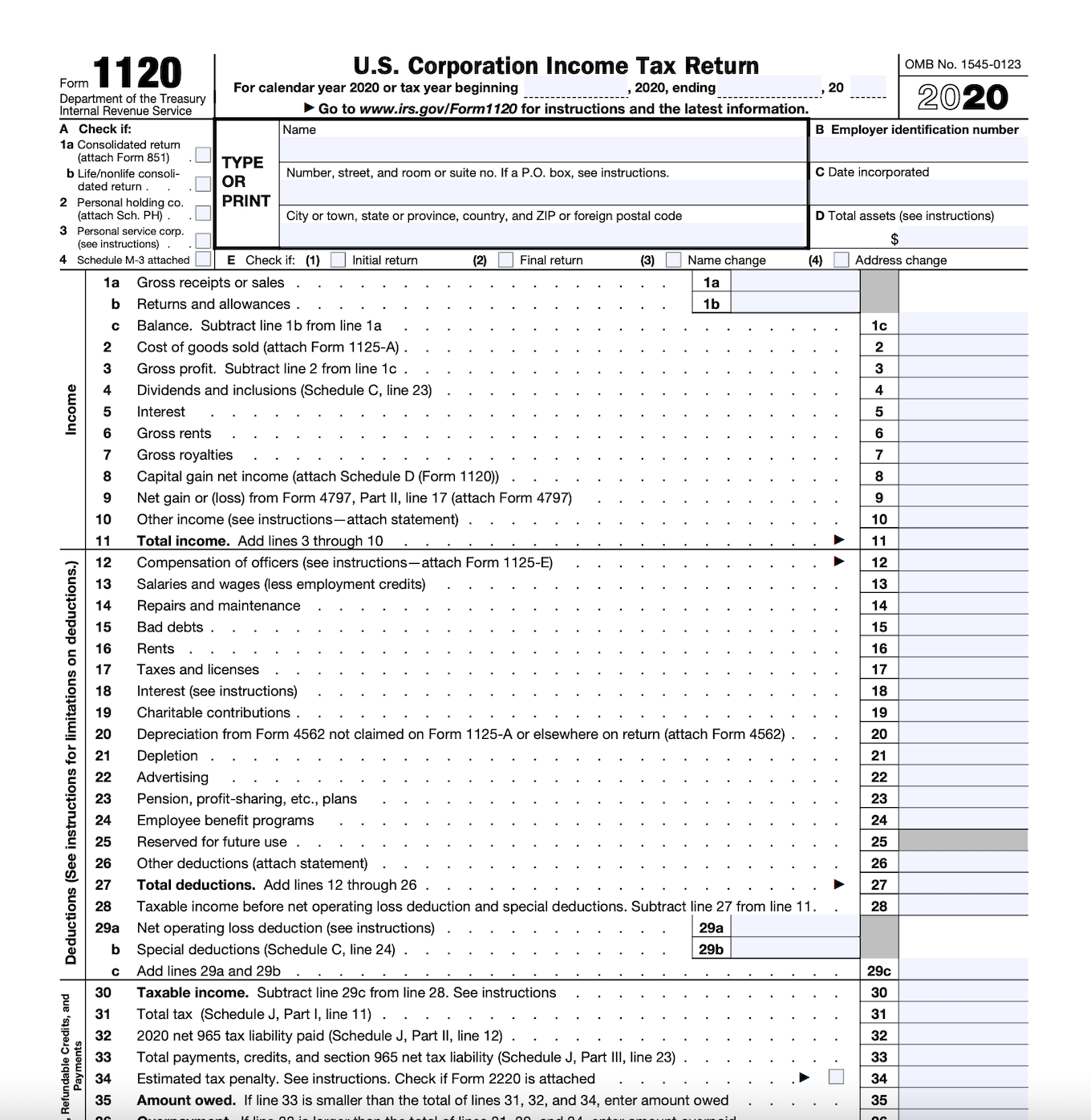

Form 1120 How To File The Forms Square

Ky Tangible Property Tax Return 2021 Fill And Sign Printable Template Online Us Legal Forms

Free Hawaii Last Will And Testament Template Pdf Word Eforms Free Fillable Forms Last Will And Testament Will And Testament Obituaries Template

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Old Version Turbotax Business 2019 Tax Software Pc Download Tax Software Turbotax Tax Refund

Corporate Tax In The United States Wikiwand

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Printable W 9 Forms Blank 2020

Sample Rental Application Form Pdf Template Forms 2022

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition